Financing Options For Your Marketing

Marketing is essential to your business, and it can be what stands between you and creating lifelong relationships with new customers. Your budget shouldn’t be the reason you can’t begin marketing your business, so we’ve made it easy and affordable to access the funds you need.

Apply Fast

Fill out our easy application in minutes, without impacting your credit one bit.

Compare Offers

Fundwell partners with over 75 lenders to bring you funding offers for your business.

Get Connected

A funding manager from Fundwell will reach out to learn more about you and your business.

Get Funded

Pick an offer, and receive business funds in approximately 24 hours.

Find the Right Financing for You

Our Financing Options are Powerful Tools

Our financing options are a powerful tool that gives your business the freedom to get things done. Our goal is to help your business grow while still giving you the financial peace of mind you need in order to succeed.

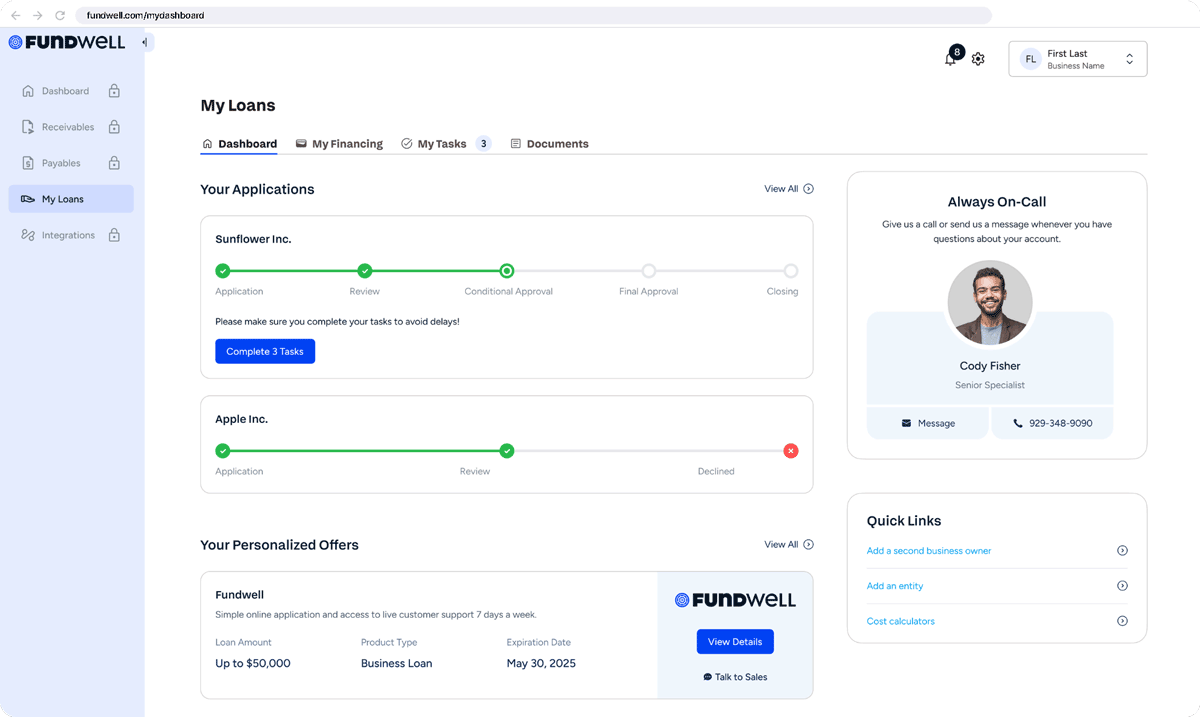

Manage Your Loan All In One Dashboard

Frequently Asked Questions

About Fundwell

What is Fundwell?

Fundwell is a financial technology platform that helps businesses access and manage capital with speed and transparency. We provide tailored financing through a nationwide network of trusted lenders and offer AR/AP and payments tools to simplify invoicing, collections, and payables.

When was Fundwell founded?

Fundwell was founded to give business owners a faster, more transparent, and more ethical way to access capital. It began as a brokerage focused on delivering funding with clarity and speed and has grown into a financial technology platform that connects businesses with financing while also streamlining AR, AP, and payments to help companies manage cash flow and drive long-term growth.

Qualifications

What qualifications go into a small business credit approval?

Traditionally, lenders look at standard qualifiers to determine creditworthiness. These can include personal and business credit scores, time in business, industry, and revenue. However, there are a number of growing non-bank lenders and non-profit lenders who are bypassing these traditional metrics and have their own requirements for loans.

Are there small business loans for bad credit?

Yes, bad credit business loans are available for business owners with personal credit scores as low as 600. However, these loans tend to come with higher interest rates and less flexible repayment terms.

What businesses are eligible for credit?

You can apply for EveryStreet as long as your business meets the minimum qualifications and does not operate in one of the following ineligible industries:

Ineligible industries

- Illegal gambling

- Pornography and paraphernalia

- Political campaigns

- Firearms and paraphernalia

- Other controlled substances (including medicinal marijuana, marijuana, cannabis, and hemp) and paraphernalia

- Financial institutions and lenders (including insurance, penny auction companies, and cryptocurrency)

- Auto dealerships

How do I qualify for financing?

To qualify for financing, eligible businesses must be a corporation or LLC in business for 12+ months, with no bankruptcies in the past year, and in good standing with your Secretary of State. Also, the business must earn $200,000 in annual revenue–and must have a 600+ personal FICO credit score.

EveryStreet will verify this information when you apply and each month after to ensure you remain eligible. The fastest way to do this is to connect your external bank account. If you don’t, you’ll need to manually upload bank statements from the last three months.

What credit score is needed for a business loan?

Each lender will have its own criteria based on the loan type. In general, you need a personal FICO Score of at least 600 and a business credit score of 80 to get a small business loan. But the lowest business loan interest rates are typically reserved for borrowers with higher credit scores.

How much income do I need to get a business loan?

Most lenders look for minimum monthly or annual revenue when you apply for a loan. It’s common to expect a minimum annual revenue requirement of $200,000 or more for unsecured loans. However, you may be eligible for a business loan with a lower annual revenue if you can provide collateral.

How can I get approved for financing?

EveryStreet will ask you for some basic information about you and your business. Once you apply, we could send you our decision in as little as five minutes.

Just make sure you meet these minimum qualifications:

- $200,000 in annual revenue

- 600+ personal FICO credit score

- In business for 12+ months

- Corporation or LLC

- No bankruptcies in the past year

- In good standing with your Secretary of State

- Business Bank Statements from the last 3 months

What credit score do you need to get approved?

For your business to qualify for financing, you must have a personal FICO credit score of at least 600+. Keep in mind that there are many other requirements our lenders may have depending on your business, such as time in business, business credit score and other factors.

General

How do small business loans work?

Business owners can take out small business loans — anywhere between $500 and $15.5 million — to finance expenses like payroll financing, inventory, equipment and other costs. Repayment terms could be as short as three months or as long as 25 years. Both traditional financial institutions and alternative online lenders offer small business loans.

Am I personally liable for a small business loan?

A personal guarantee requires you as the business owner to be personally responsible for the company’s debt in case of default. A personal guarantee is fairly common on small business loans because it lowers the risk for a lender. But as the business owner, it may limit any protections your business structure offers.

What purposes do small businesses use loans for most?

Small business owners use business loans for an array of expenses. The most common uses of funds among EveryStreet customers include working capital, equipment, business expansion, payroll, and real estate.

What are the most common kinds of business capital?

There are a wide variety of financing options for small businesses. Some of the most popular forms of business capital are term loans, SBA loans, accounts receivable financing, lines of credit, equipment financing, and merchant cash advances.

Which industries are most in need of capital?

The most common industries in search of capital are construction, restaurants, retail, healthcare, and transportation.

How do SBA loans differ from other financing options?

SBA loans are loans guaranteed by the federal Small Business Association, mitigating the default risk to the lender. This guarantee makes it easier for younger businesses, or business owners who lack credit, to be approved.

What’s the difference between a term loan and a line of credit?

Term loans and lines of credit are two different types of business loans:

- A term loan provides a lump sum upfront. You repay on a fixed schedule until you’ve repaid the full sum.

- A line of credit provides access to ongoing funds from which you can request one or more draws and borrow any amount up to your given limit. You repay only what you’ve borrowed on a fixed schedule.

Your repayment schedule and terms may vary and are determined by your lender.

What can I use a business line of credit for?

Think of a business line of credit as funds your company can request and use if and when you need it. With a EveryStreet Line of Credit, you only pay for what you use, and your available credit line replenishes as you make repayments on your draw(s). All draw requests are subject to review and approval. As you build history, the size of your credit line can scale with the size of your business.

A business line of credit provides greater flexibility to your business, allowing you growth opportunities that might otherwise be unavailable to you. For example, a line of credit can provide financial stability if you encounter unexpected expenses or seasonal fluctuations in revenue.

If you’re looking to boost your growth, you can purchase more inventory or operations equipment, or fund a new marketing campaign. If you’re expanding, a line of credit can help you open a new office or location, or it can support a new product launch.

How can a Fundwell Line of Credit help grow my business?

With funds as fast as 24 hours, simple interest rates, and no prepayment penalties, an EveryStreet Line of Credit lets you take advantage of growth opportunities early. You could use a line of credit to cover payroll, hire full-time or seasonal employees as you need them, stock up on extra inventory during a sales rush, or buy materials or equipment for your next big project. You could also renovate your office, warehouse, or storefront, or lease a larger one.

Does applying with Fundwell affect my credit score?

While applying and reviewing an offer will not impact your personal credit score, accepting an offer may result in a hard inquiry.

How It Works

How long is the application process?

Applying for a business loan is a streamlined process. Simply fill out the Business Loan application. Fundwell only asks for what is necessary to approve your loan.

You’ll need your basic information, EIN, and 4 month’s worth of your business’s bank statements*.

Here is an overview of the process:

- Apply online in 3 minutes or less.

- Meet your financing specialist.

- Build out your loan terms and a payment plan that works for you.

- Receive your funds in as little as 24 hours after completing underwriting requirements and contract signing.

*Plaid business bank connection is also accepted in place of bank statements.

How Long Does the Business Loan Application Process Take?

Applications can be completed online in just a few minutes and you could find out if you’re approved in as little as 5 minutes. Generally, decisions are made and communicated within 1-2 business days.

How fast can I expect a credit decision when I apply?

When you apply with EveryStreet, you could find out if you’re approved in as little as 5 minutes. Generally, decisions are made and communicated within 1-2 business days.

How fast can I receive my funds?

Once your application is approved, you can get funds deposited to your bank account in as quickly as a few hours if you fulfill all the document requirements.

How much credit can I get?

Fundwell offers credit lines up to $1,000,000, but your line amount will depend on what you’re approved for when you apply, plus whether you qualify for line increases later on. Your available credit replenishes as you make repayments. Draw requests are subject to review and approval. Additionally, we offer business loans of up to $5,000,000 and SBA loans, which can reach a maximum of $5,000,000.

*Frequently asked questions provided by Fundwell.

Have Questions?

Get in touch with an Fundwell team member.

- 1-800-613-0257

Let us help you reach your revenue goals!

Ready to grow your business?

Get started with a Free Marketing Assessment

Be on your way to more customers within 48 hours with our Free Marketing Assessment. Learn the best opportunity for your business from one of our industry marketing consultants.